Creating and Listing Options

Prop desks, Hedge funds can use clearing/ settlement infra to create custom options and trade them OTC (Initially invite only feature)

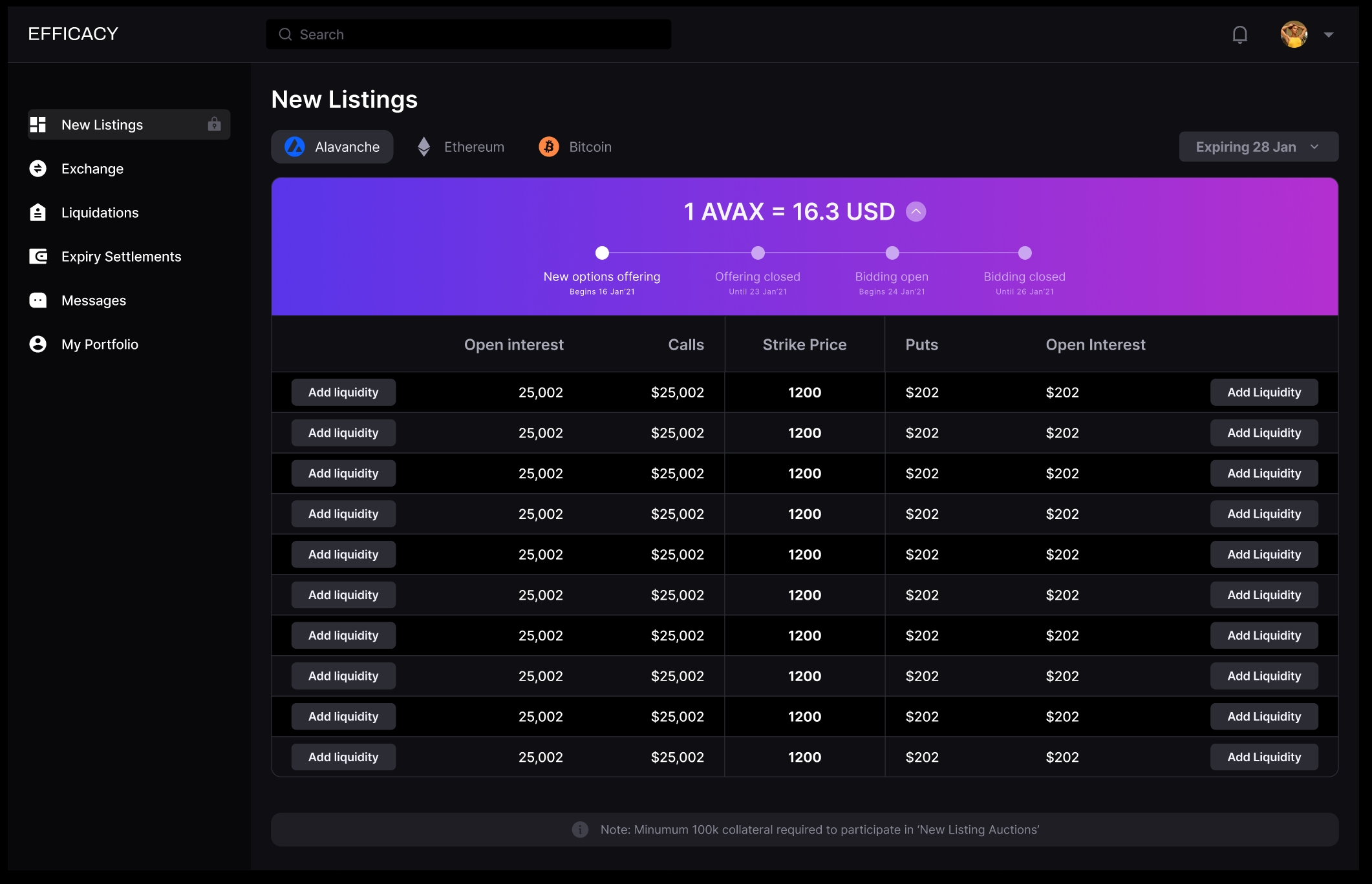

Creating and Price Discovery Process

Closed Bid Auction

Protocol team whitelists primitive options products (set of assets and expiries (ETH, Calls, 28 Jan expiry, USDC collateral, cash settled)

Users can decide specific configurations and create an option of their choice. Listing can be done publically or privately in case they want to sell it at a predetermined price to a buyer.

All custom options and spreads are full collateralised assuming max seller loss.

Users (LPs in this case), put up collateral and mint eTokens (ERC-20 / SPL equivalent of options). Initial minting phase is open for 5 days (~1 week)

Once minting phase closes, a Blind Dutch/ Vickery Auction begins and option buyers quote a price (hence, option buyers are Market Makers in this case, and LPs are price takers)

Auction lasts till complete Open Interest is bought off. If the auction isn’t filled within a day, if > 50% of the OI is filled, remaining token are burnt (which LP’s eTokens are burnt is LIFO)

These minted contracts can now be actively traded in the open market by any user, initial quotes for these will start appearing on our Exchange UI

Last updated